BENJAMIN SOLEIMANI AND SHARYN SOLEIMANI, Petitioners

v.

COMMISSIONER OF INTERNAL REVENUE, Respondent

United States Tax Court Filed May 15, 2023

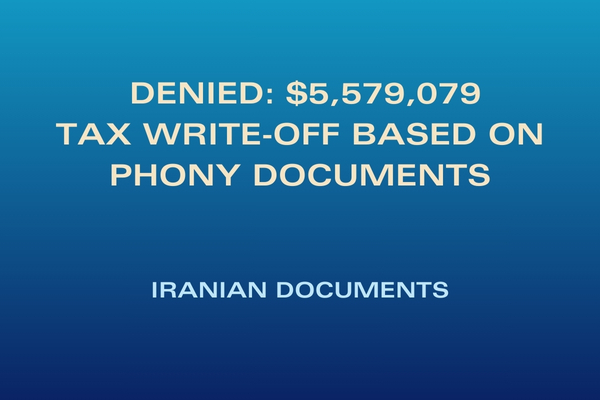

The petitioners claimed they had owned Iranian property which was confiscated by the Iranian government, claiming a $2,725,000 long-term capital loss deduction, which they later increased to $5,579,708 on an amended return which they claimed entitled them to a refund. The respondent hired an expert who researched the Iranian property records. The expert found that the Iranian properties had never been owned by the petitioners or the Iranian government. In addition, documents provided by petitioners’ “expert” to the Court to were found to be forgeries. The “expert” who provided the false documents claimed to be a lawyer, but could not be found by his name, address, phone number or bar number in any official records.

Petitioners presented documents at trial that purported to substantiate petitioner’s claimed ownership of the Iranian properties, their values, and their expropriation by the Iranian government in 2007. However, on the basis of the report and testimony of respondent’s expert, we find that the documents are forgeries and that the Iranian lawyer petitioners claimed to have relied on to obtain the documents was also a fabrication. We reach these conclusions for the reasons which follow…

Respondent engaged an expert and submitted his report. Respondent’s expert’s report concluded inter alia that Mohammad Ali Soltanpour was a fictitious person. He visited the addresses listed for Mr. Soltanpour in Tehran; no one at those addresses had any knowledge of anyone by that name. He tried the phone numbers listed for Mr. Soltanpour and encountered the same. Finally, he researched Iranian Bar Association listings and found no entry for anyone by that name. Indeed, the bar number given for Mr. Soltanpour on the Declaration had never been issued to anyone, according to Iranian Bar Association records. The Report further concluded that the Registration and the Declaration were forgeries because, inter alia, they were purportedly issued to a nonexistent Iranian attorney with a fictitious bar number, they stated property values in U.S. dollars, and two of the properties referenced in the documents as owned by petitioner before their confiscation by the Iranian government could in fact be traced in Iranian property records, and those records showed that the properties had at no time been owned by petitioner or the Iranian government. (Respondent’s expert was unable to find any records pertaining to the third property.) A supplemental trial was conducted to afford petitioners an opportunity to crossexamine respondent’s expert and to receive additional evidence pertaining to the apparent discrepancies identified in respondent’s expert’s report….

Read the Case